Why Kazakhstan’s Central Bank Must Protect Price Stability—Even If It Weakens Growth in the Short Run, As inflation takes off around the world, central banks are racing to fix money related arrangement to follow through on their orders of maintaining price stability.

In Kazakhstan, raising interest rates has demonstrated fundamental to stay away from a winding of inflation, cash deterioration and dollarization, as verified in our new Article IV report. Indeed, the National Bank of Kazakhstan might have to fix money related arrangement further to bring inflation back to target and secure inflation assumptions — despite the fact that that could debilitate prompt financial growth.

Price stability is a condition for macroeconomic stability and sustainable monetary growth. It likewise protects ways of life. Inflation, conversely, is the most terrible duty on poor people. It is critical that central banks maintain individuals’ confidence in their ability to keep prices stable. This is why, across the world, price stability is their overriding goal.

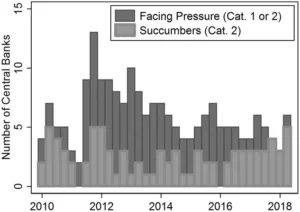

As we see today, situations inevitably emerge when nations face a compromise between preserving price stability and supporting growth. This is the point at which the independence and credibility of central banks is tried Dow Jones Dives After Key Inflation Report, and there is a gamble that individuals lose trust in the financial authorities’ ability to keep prices from spiking. Interest rates may then need to ascend significantly higher to accomplish a similar stabilizing impact.

Targeting inflation in Kazakhstan

Kazakhstan has had a positive encounter of transitioning to inflation targeting, where the central bank is commanded to maintain a certain degree of price increases, rather than target growth, the cash supply, or the conversion scale. The NBK’s increased spotlight on homegrown price stability and dependence on conversion scale flexibility has helped anchor inflation assumptions and retain outer shocks since 2015.

However the transition remains incomplete. More advancement is important, including to diversify the economy, diminish dollarization, and limit openness to outer shocks. The drawn out benefits are significant, and the NBK’s Monetary Policy Strategy 2030 spreads out thorough changes to address large numbers of these difficulties.

Simultaneously, care must be taken to abstain from broadening the NBK’s command or diluting its independence. Pursuing numerous targets in the midst of the difficulties of keeping prices stable could hinder money related arrangement adequacy and accountability.

International experience proposes a more streamlined order for the NBK is alluring. Phasing out non-center activities, for example, financed lending programs and other semi financial jobs, would increase the viability of money related arrangement and the independence and credibility of the NBK.

Different shocks, numerous strategies

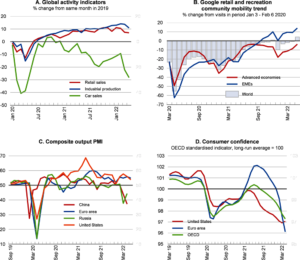

The present monetary climate — in Kazakhstan and the more extensive world — is described by different shocks: the COVID-19 pandemic, production network disturbances, the conflict in Ukraine and assents against Russia. Numerous public institutions play a part in implementing strategies to decrease the quick pain, particularly for the most powerless, and support long haul growth and inclusion.

Legislatures can utilize financial strategy to set up homegrown interest and growth, particularly when high inflation limits the degree for money related extension. This is the situation in Kazakhstan, where raised oil incomes give space to increased spending. Monetary strategy must, obviously, find some kind of harmony between supporting the economy, preserving financial sustainability, and maintaining macroeconomic stability.