Analyst sees 45% rally, recommends buying Twitter ahead of Musk legal battle, Add one more name on Wall Street to the rundown of those getting bullish on Twitter shares as the organization plans for a possibly extensive court battle with Elon Musk.

Long-term tech analyst Barton Crockett of Rosenblatt Securities lifted his rating on Twitter’s stock to Buy from Neutral in another note to clients this week, taking his cost focus on the stock to $52 from $33, which accepts generally 45% potential gain from current cost levels.

“We surveyed new, more point by point divulgences in Twitter’s claim against Elon Musk, and our previous distrust about Twitter has been flipped,” Crockett said.

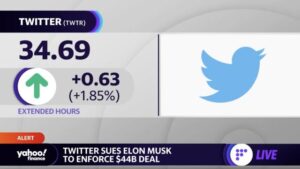

In a suit recorded Tuesday in Delaware, Twitter battles that Musk made his offer to purchase the organization “without looking for any portrayal from Twitter in regards to its evaluations of spam or misleading records.” Musk consented to purchase Twitter for $54.20 per share back in April.

“We had previously seen significant gamble (dependent generally upon Musk’s statements and furthermore a past filled with mDAU repetitions) Celebrity Pregnancy Announcements, that Twitter was being shifty in revelation of its spam bot estimations,” Crockett said.

“That drove us to expect that Musk had influence to separate a significant admission to stay away from disclosure harming to Twitter in a court cycle. In any case, Twitter’s exposure of extremely itemized endeavors to clear up its spam bot estimations for Musk, and Musk’s hesitance to connect with, generally closes our doubt about Twitter, and on second thought makes us suspicious about Musk.”

In its suit, Twitter said the organization outfitted Musk and his group with adequate data — as expected by the gatherings’ consolidation understanding — in regards to the predominance of bots on the stage. Twitter’s attorneys added Musk has for some time known about the organization’s openly expressed philosophy for assessing counterfeit records, in view of Twitter’s administrative filings.

Twitter director Bret Taylor tweeted the suit intends to “consider Elon Musk responsible to his authoritative commitments.”

“Twitter currently seems to be an uncommonly engaging close term an open door, in a market in any case pounded by full scale concerns,” Crockett said.

Notwithstanding the new legal exposure, Twitter shares have held up somewhat well this week — declining 1.5%. The S&P 500 and Nasdaq Composite are down around 3% up to this point this week.

Portions of Twitter may likewise be getting some help from another transient bull that is a recognizable face on the Street.

On Wednesday, the famous short-merchant research firm Hindenburg Research revealed in a tweet it has taken a long position — or wagered on shares going higher, not lower — in Twitter.

Hindenburg Research organizer Nathan Anderson told Yahoo Finance the stake is under 5% of Twitter’s exceptional offers. The bet seems to be one made on the reason Elon Musk will be constrained by the courts to purchase Twitter at the settled upon $54.20 an offer cost.

Like Rosenblatt’s Crockett, Anderson says Twitter currently has influence over Musk in the courts.

“There is a typical misinterpretation that just $1 billion is on the line,” Anderson told Yahoo Finance. “Twitter is suing to uphold the whole $44 billion consolidation cost, and they have areas of strength for a. Musk has wasted quite a bit of his influence, generally through less than ideal enthusiastic tweets.”

Anderson added: “From a gamble reward point of view Twitter makes for a convincing long at these levels.”

Brian Sozzi is a proofreader at-large and anchor at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.

Click here for the most recent moving stock tickers of the Yahoo Finance stage

Click here for the most recent financial exchange news and top to bottom examination, including occasions that move stocks.