Dow Steadies, NIO Slumps — and What Else Is Happening in the Stock Market Today, Stocks were trying to find their footing Wednesday in the midst of reestablished worries about financial development and whether national banks are raising interest rates excessively fast.

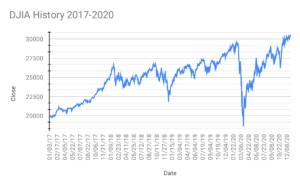

In evening time trading, the Dow Jones Industrial AverageDJIA +0.27% has risen 95 points, or 0.3%, while the S&P 500SPX – 0.07% was down 0.1%, and the Nasdaq Composite has plunged 0.2%. The S&P 500 and Nasdaq withdrew 2% and 3% on Tuesday, individually.

Abroad, the container European Stoxx 600 lost 0.7% and Hong Kong’s Hang Seng Index tumbled 1.9% as Asian bourses followed Wall Street’s downbeat execution in the last meeting.

However Tuesday got going fine, stocks wound up suffering their most terrible day in about fourteen days as investors soured on downbeat signals from the customer certainty index Yungblud drops Don’t Feel, on that additionally showed continued worries about inflation. ”

[Not] just did the headline seriously miss assumptions, falling to a 16-month low, however purchaser inflation assumptions for the year ahead within the report hopped from an upwardly revised 7.5% to 8.0%, which strikingly goes against the pullback in the final University of Michigan informational collection from last Friday that lighted the latestrally in stocks,” composed The Sevens Report’s Tom Essaye.

Presently, the markets will tune in for signs about what the Fed intends to do as national brokers meet at a highest point in Portugal. Taken care of Chair Jerome Powell will convey comments close by partners from the Bank of England and European Central Banks.

“As could be, markets will take apart [Powell’s] each word, looking for hints for this situation, that the Fed is wavering on its hawkish inclination as recessionary feelings of trepidation rise,” said Jeffrey Halley, an investigator at agent Oanda. “They are probably going to be disappointed, yet it ought to be really great for some intraday [volatility].”

In front of Powell’s comments, the leader of the Cleveland Fed, Loretta J. Mester, let CNBC know that the national bank was “right toward the beginning” of hiking rates to control inflation. Acknowledging the risk of downturn, Mester said she upheld another super estimated 75 basis-point rate climb in July assuming financial circumstances remain unaltered. The average interest-rate increase is 25 basis points.

Investors will likewise be eyeing a revision to first-quarter U.S. total national output information Wednesday in the midst of stresses over the monetary picture. The yield on the 10-year U.S. Depository note was hovering around 3.11%, down from above 3.2% recently.

Tuesday’s decline raised doubt about whether a base had truly been shaped last week following the stock market’s enormous convention — and bears are feeling restored.

“We don’t completely accept that the stock market has lined at this point and we see further downside ahead,” said George Ball, the seat of investment bunch Sanders Morris Harris. “We see the S&P 500 bottoming at around 3,100, as the Federal Reserve’s forceful, however vital, inflation-fighting measures are probably going to push down corporate earnings and push stocks lower.”

Simply Eat Takeaway.com (JET.UK) tumbled 20% in London trading after examiners at Berenberg initiated inclusion of Europe’s biggest online food conveyance bunch with a Sell rating, citing risks over the organization’s capacity to dispose of its U.S. Grubhub business.

Shower and Body Works (BBWI) has dropped 8.9% in the wake of getting sliced to Neutral from Overweight at JPMorgan.

Bed Bath and Beyond BBBY – 23.58% (BBBY) has drooped 23% in the wake of announcing that its CEO had “left his job” following a bigger than-anticipated quarterly misfortune.