At the point when you purchase a home with a FHA credit and don’t have something like 20% to put down, mortgage moneylenders expect you to pay a Monthly Mortgage Insurance Premium For FHA, which shields them from misfortune in the event that you can’t reimburse the credit. FHA advances are appealing to certain purchasers since they accompany indulgent credit necessities, low shutting costs and serious loan fees. The additional cost of FHA mortgage insurance, however, is a vital downside to this road of funding.

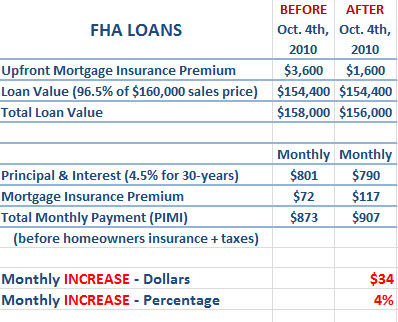

FHA borrowers need to pay two sorts of interest rate on a mortgage premiums: forthright and yearly. The forthright mortgage insurance premium s charged at your mortgage shutting when you initially get your advance, while the yearly premium is a continuous commitment you pay yearly. These mortgage insurance premiums (MIP) safeguard the loan specialist in case of a mortgage default. As a rule, you’re liable for FHA MIP for the existence of your credit.

Mortgage insurance safeguards banks from losing cash assuming that you default on the credit. Most banks require Monthly Mortgage Insurance Premium For FHA for standard mortgages when the home purchaser makes an up front installment of under 20%. The equivalent goes for refinancers with under 20% value.

What is a FHA mortgage insurance premium (MIP)?

A FHA mortgage insurance premium (MIP) is an extra expense you pay to safeguard the bank’s monetary advantages in the event that you default on your FHA credit. FHA borrowers are expected to pay two mortgage insurance premiums: one forthright at shutting, and another yearly however long you reimburse the advance, much of the time.

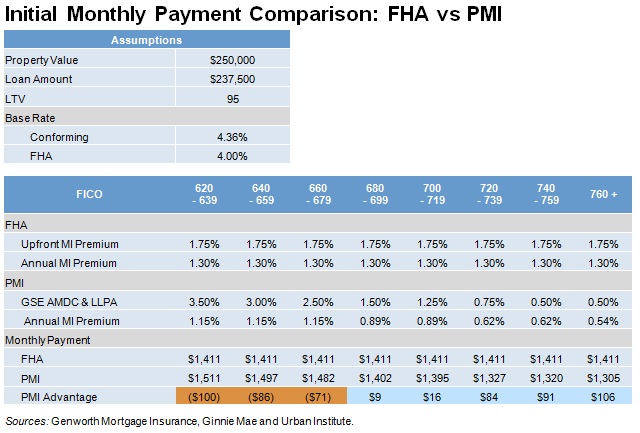

By comparison, standard mortgages with under 20% down accompany private mortgage insurance (PMI), charged consistently until you have somewhere around 20% value in your home. In this sense, PMI is unique in relation to Monthly Mortgage Insurance Premium For FHA, which doesn’t have a similar value cutoff.

How much does FHA mortgage insurance cost?

- FHA Forthright MIP: 1.75 percent of credit sum

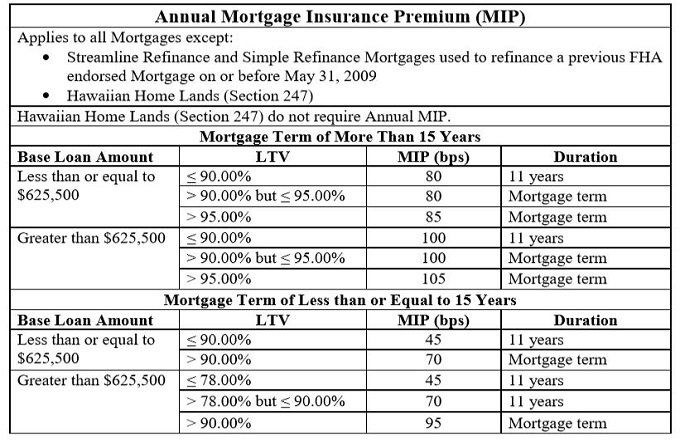

- FHA Yearly MIP: Changes in light of the size, term and advance to-esteem (LTV) proportion of the credit

MIP expenses can shift contingent upon a couple of elements, including the term of your credit and how much cash you put down. More limited terms and bigger initial investments will quite often bring about lower MIP costs.

How to dispose of FHA mortgage insurance

One of the principal ways of disposing of FHA MIP is to make basically a 10% up front installment at shutting. You’ll in any case pay the premiums, yet only for 11 years.

Another method for getting a Monthly Mortgage Insurance Premium For FHA expulsion it is to renegotiate into a typical mortgage — however, there are a few things you’ll have to do to plan for a refi, including:

- Having a record as a consumer that is liberated from any blemishes that could prevent you from meeting all requirements for a renegotiate

- Further developing your financial assessment to 620 or higher

- Working somewhere around 20% home value (otherwise, you’ll pay for PMI subsequent to renegotiating)

All things considered, FHA mortgage insurance may not bother you much in the event that you’re a first-time homebuyer. The advantage of making a little initial investment and accomplishing homeownership sooner — rather than setting something aside for a 20% up front installment — may offset the disadvantage of conveying this additional credit cost.

Eliminating mortgage insurance

The insurance necessity is a vital contrast among FHA and typical mortgages. With a standard mortgage, confidential mortgage insurance might be dropped after you have acquired adequate value (typically 20%). It’s dropped consequently after your value comes to 78% of the price tag.

FHA mortgage insurance can’t be dropped in the event that you make an initial investment of under 10%; you dispose of Monthly Mortgage Insurance Premium For FHA by renegotiating the mortgage into a non-FHA credit. At the point when you put 10% or more down on a FHA advance, you pay mortgage insurance premiums for 11 years rather than the existence of the credit.