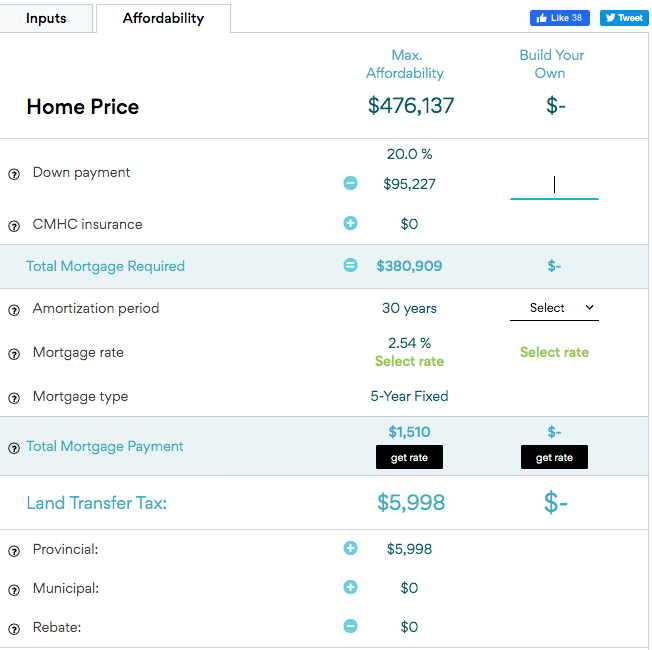

This number cruncher is made accessible to you as an instructive device just and estimations depend on borrower-input information. This isn’t an ad for the above terms, interest rates, or installment sums. Mortgage Affordability Work in Canada not ensure the appropriateness of the above terms concerning your individual conditions. Computations don’t consider certain advance explicit expenses, including yet not restricted to mortgage insurance, variable mortgage insurance charges, funding charges, HOA expenses, and so on.

While shopping for a house, it’s critical to determine the most extreme mortgage and home value you can meet all requirements for. Mortgage Affordability Work in Canada alludes to how much you can stand to get from a mortgage supplier – your greatest affordability is just the most extreme sum that you can get. To determine your greatest affordability, loan specialists consider a few variables.

Affordability adding machines need to consider government stress testing guidelines distributed by the Workplace of the Superintendent of Financial Institutions (OSFI). You should in any case have the option to manage the cost of your halifax take to release mortgage funds assuming that your interest rate increases to the more prominent.

Why compute mortgage affordability?

While you’re looking to purchase a house, it’s convenient to know how much you can manage. Being ready to ascertain a gauge of how much you’re ready to get is a significant piece of setting your financial plan.

You likewise need to determine on the off chance that you have sufficient money assets to buy a home. The money required is gotten from the initial investment put towards the price tag, as well as the closing costs that should be incurred to finish the buy. We can assist you with estimating these closing expenses with the principal tab under the Mortgage Affordability Work in Canada above.

Taken together, understanding how huge a mortgage you can stand to get and the money prerequisites involved will assist you with determining what kind of home you ought to be keeping watch for. To study mortgage affordability and how our number cruncher works, have a perused of the information underneath.

What is mortgage affordability?

Mortgage affordability alludes to how much you’re ready to get in light of your ongoing income, obligation and living costs. It’s basically your purchasing power while buying a home. The higher your Mortgage Affordability Work in Canada, the more costly a home you can bear to buy.

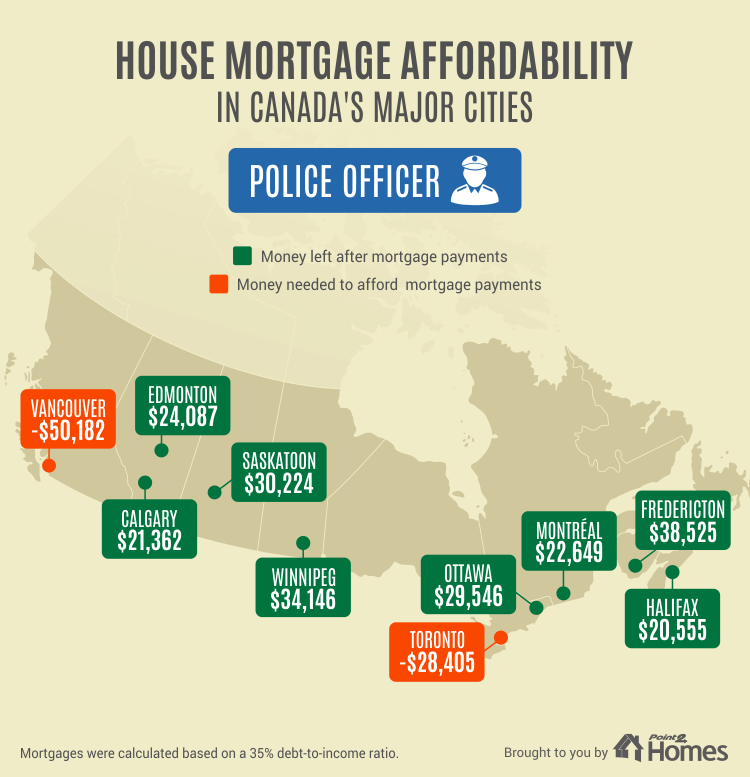

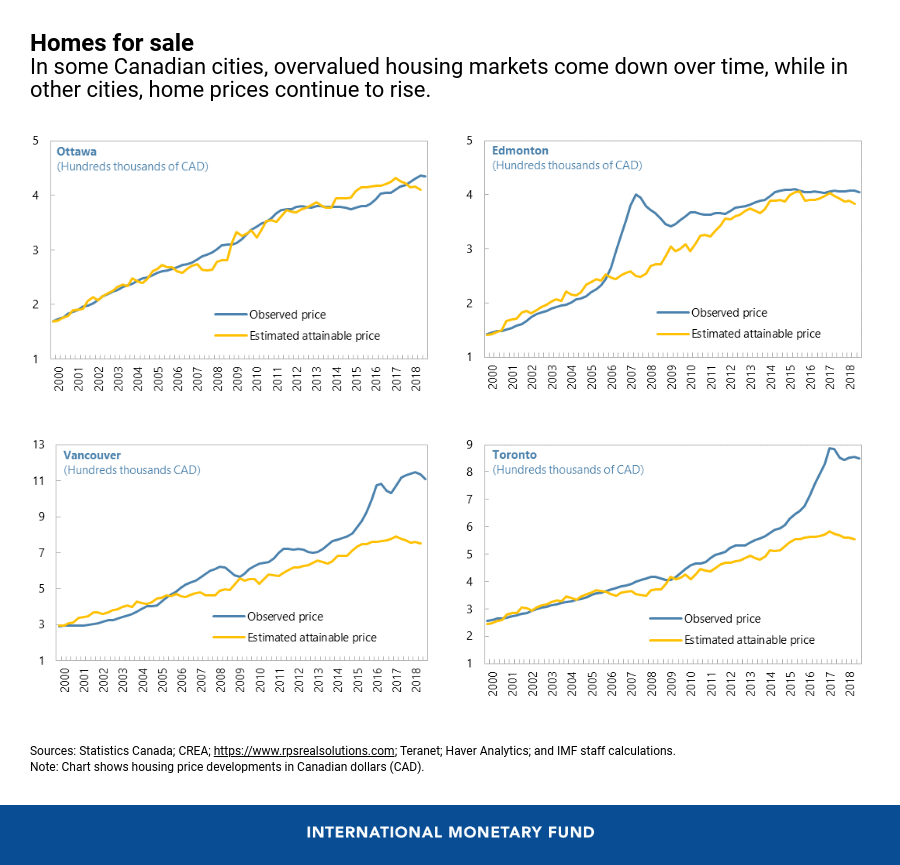

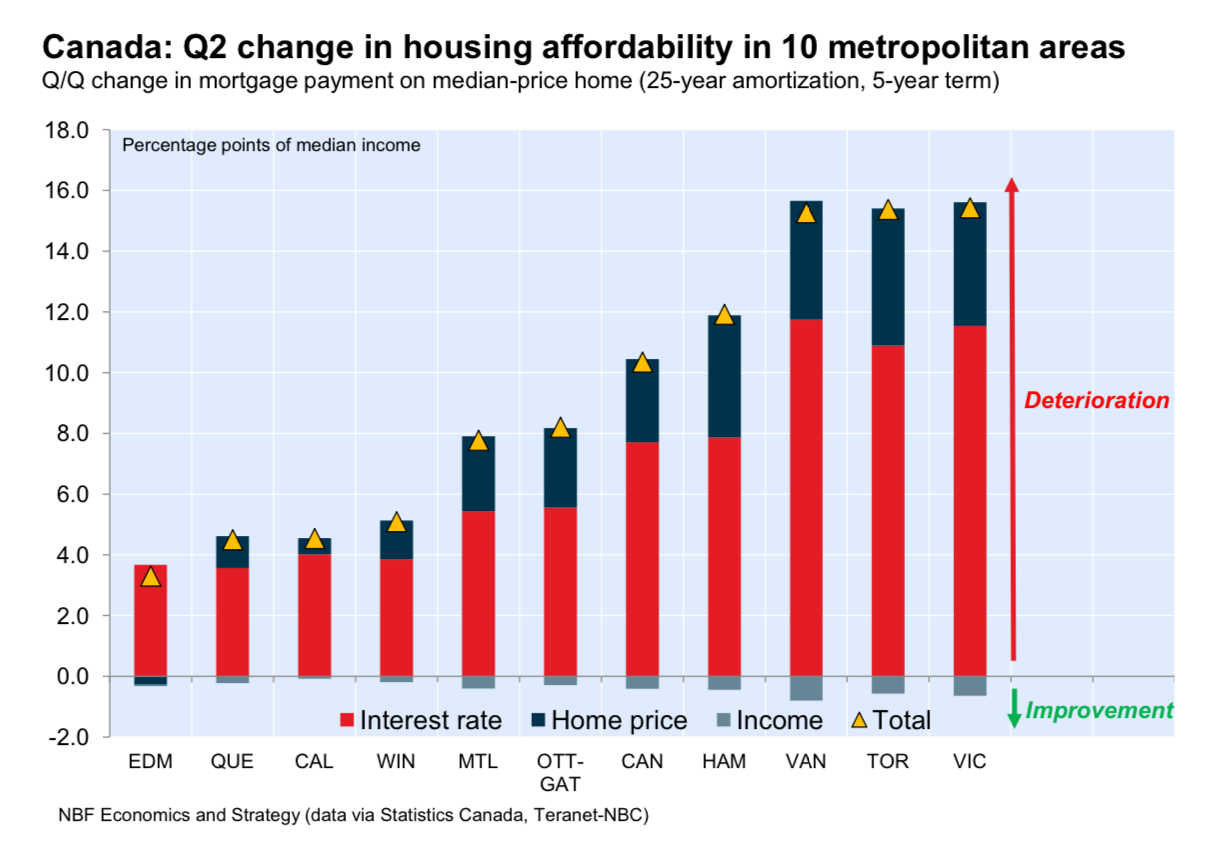

The term ‘affordability’ is likewise used to depict generally housing affordability, which has more to do with the typical cost for many everyday items in a specific city. In the event that the expense of housing comparative with the typical income in a city is high, it will be viewed as a more expensive spot to live. The two terms are connected, however understanding the difference is significant.

There are many elements that will influence the greatest mortgage you can stand to get, including the family income of the candidates purchasing the home, the individual month to month costs of those candidates (vehicle installments, credit costs, and so forth) and the costs related with owning a home (local charges, apartment suite expenses and heating costs, and so on.).

Mortgage affordability and your initial installment

Since Canada has minimum initial installment rules set up, how much cash you’ve put something aside for an initial investment can restrict your greatest mortgage affordability. The minimum initial investments in Canada are:

- 5% of the price tag up to $500,000, in addition to

- 10% of any piece of the cost somewhere in the range of $500,000 and $1 million, or

- 20% of the absolute price tag for homes esteemed at more than $1 million.

We should think about a model. Assuming that your initial investment sum is fixed at $15,000, the most extreme home value you will actually want to manage is $15,000 partitioned by 5%, or $300,000. On the off chance that your initial installment is $30,000, your greatest affordability will increase to $550,000. You can run the numbers yourself on our mortgage affordability mini-computer.

How to increase your most extreme mortgage affordability

Assuming you’ve utilized our mortgage affordability mini-computer and you’re discontent with your outcomes, there are a few stages you can take to increase your mortgage affordability:

- Increase your initial installment: This will enable you to increase your affordability and buy a more costly home. Numerous Canadians do this with family help, otherwise called borrowing from the Bank of Mother and Pop.

- Take care of your obligations: This will bring down your TDS proportion and let loose a greater amount of your income for your mortgage installment, eventually giving you the capacity to convey a bigger mortgage and consequently bear the cost of a more costly home.

- Increase your income: This is the harder choice, yet it will permit you to bear the cost of a bigger month to month mortgage installment, which will increase the general size of the mortgage you can stand to get and reimburse. One method for doing this is by switching to a superior paying position, however changing position during the homebuying system can be hazardous. On the other hand, you can apply for your mortgage with your accomplice, or get a co-endorser, like your folks, to ensure your mortgage.

These are only a couple of ways you can increase the sum you can stand to spend on a home, by increasing your Mortgage Affordability Work in Canada. However, the best counsel will be private to you. Find an authorized mortgage representative close to you to have a free, no-commitment discussion that is custom-made to your requirements and for nothing.

How to Use the mortgage affordability number cruncher

To utilize our mortgage affordability number cruncher, just enter your and your accomplice’s income (or your co-candidate’s income), as well as your living expenses and obligation installments. The number cruncher can gauge your living costs in the event that you don’t have any acquaintance with them.

With these numbers, you’ll have the option to compute how much you can stand to get. You can likewise change your amortization period and mortgage rate to perceive how that would influence your Mortgage Affordability Work in Canada and your regularly scheduled installments.