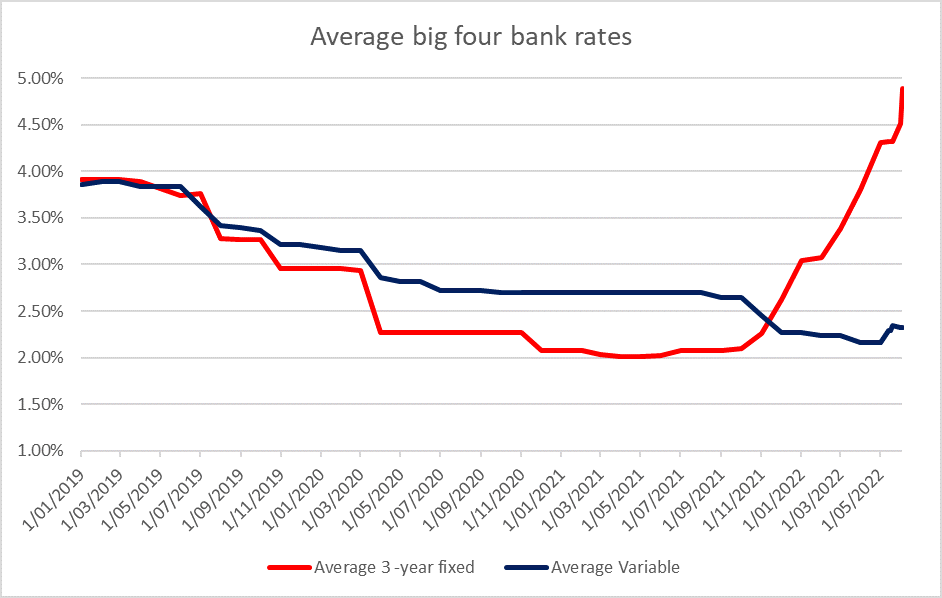

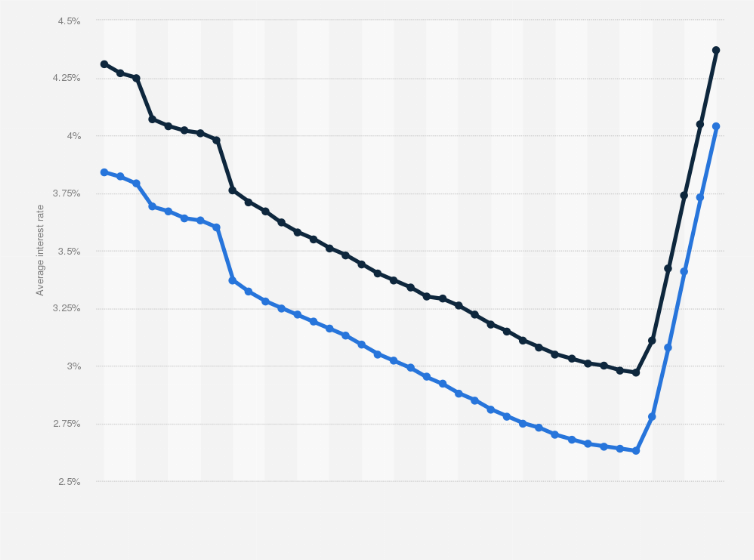

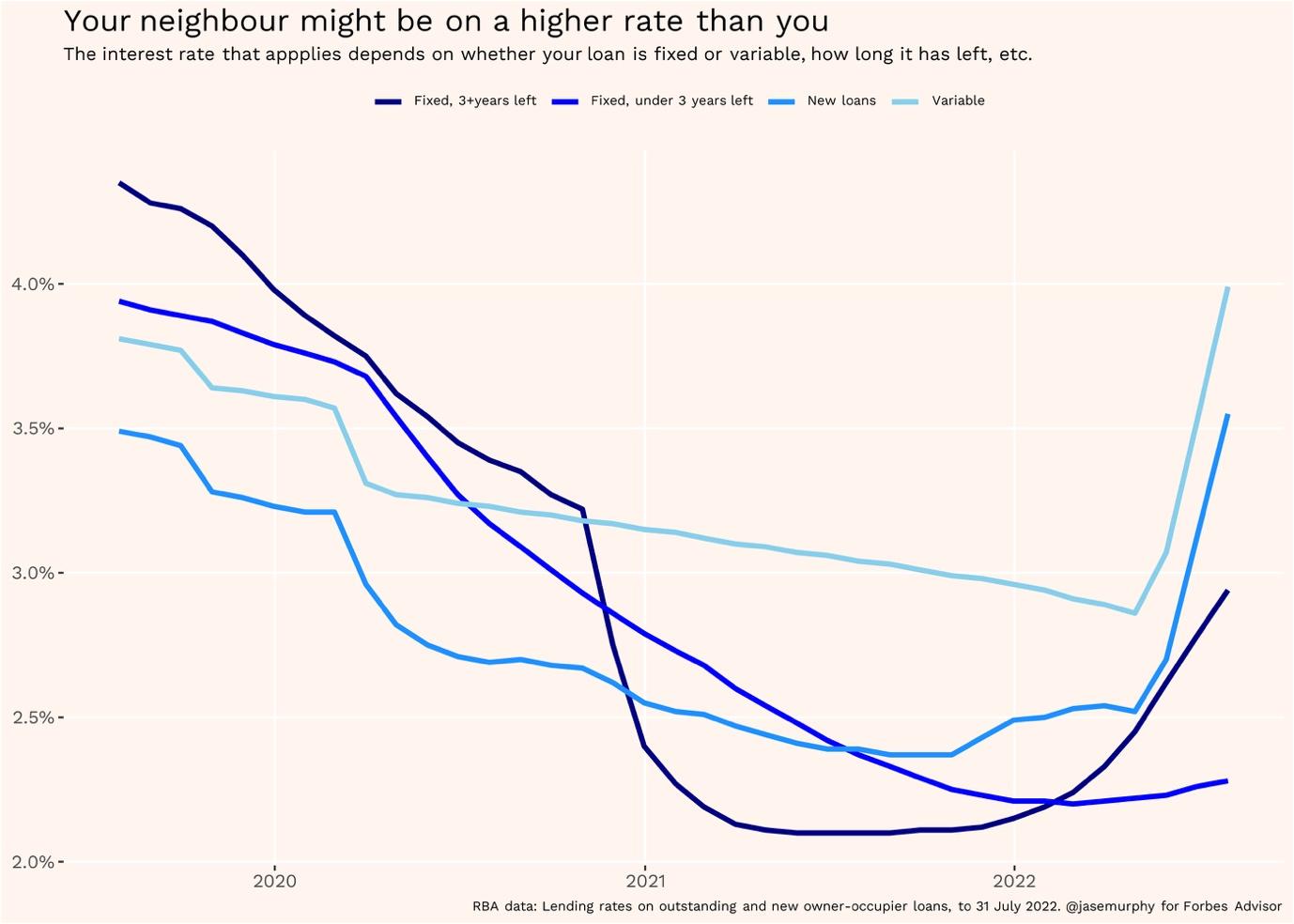

The best Home Loan Mortgage Interest Rate in Australia can vary depending on the lender and the type of loan. Fixed rate loans, for example, generally have higher interest rates compared to variable rate loans. However, fixed rate loans provide more stability and predictability, as the interest rate remains the same for the duration of the loan term. On the other hand, variable rate loans may have lower interest rates, but the rate can fluctuate over time based on market conditions.

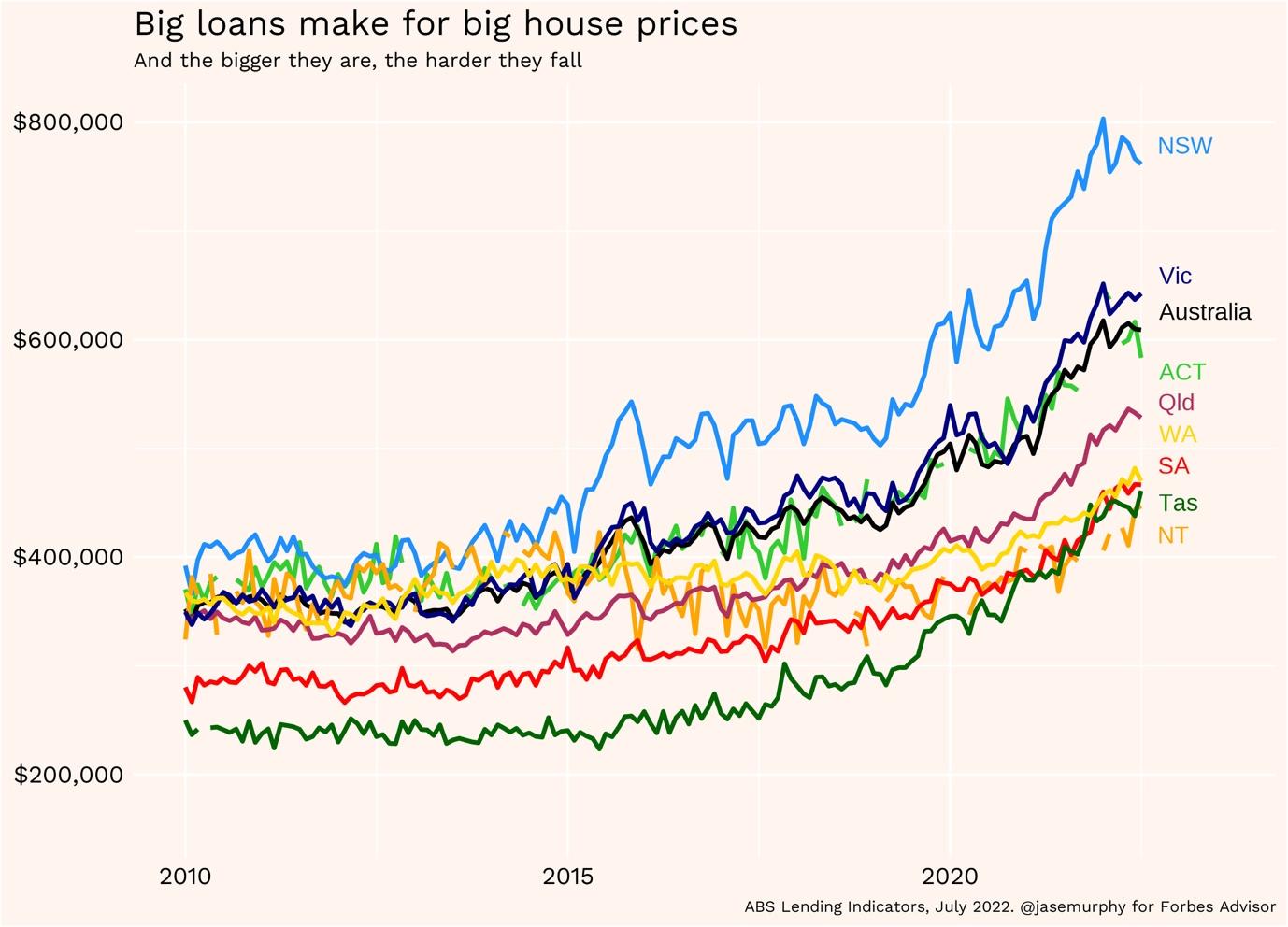

In addition to the type of loan, other factors that can impact the interest rate include the size of the loan, the borrower’s credit score and income, and the property’s location and value.

It is important to shop around and compare Benefit of Obtaining a Personal Loan from different lenders to find the best deal. This can be done by comparing the annual percentage rate (APR) which includes the interest rate and any additional fees. The APR will give you a more accurate picture of the overall cost of the loan.

It is also important to consider other factors such as fees and terms in addition to the interest rate. For example, some lenders may charge higher fees for Home Loan Mortgage Interest Rate, closing costs, or early repayment.

It is always recommended to consult with a financial advisor or a mortgage broker to get the best rates and advice. They can help you understand the different loan options available and guide you in making an informed decision. They can also help you negotiate with the lender to get the best deal possible and assist you through the loan application process.

Normal home loan rates in January 2023

At the hour of writing, the typical rates for a $400,000 loan (OO, P&I, LVR >80%) among moneylenders we track are:

- Variable rate: 5.64% p.a.

- Huge 4 variable rate: 6.24% p.a.

- 1-year fixed rate: 5.46% p.a.

- 2-year fixed rate: 5.82% p.a.

- 3-year fixed rate: 6.02% p.a.

- 4-year fixed rate: 6.30% p.a.

- 5-year fixed rate: 6.45% p.a.

To find out how interest rates are tracking in other banking items for January, look at our depictions for Individual Loan Interest Rates, Vehicle Loan Interest Rates, Savings Record Interest Rates and Term Store Interest Rates.

What’s happening to mortgage rates in Australia?

Home loan interest rates are impacted by a wide assortment of financial elements, both in Australia and abroad. One critical component is the public money rate, which is set by the Save Bank of Australia (RBA). Home Loan Mortgage Interest Rate by and large rise when the money rate is increased and fall when the money rate is cut.

One time each month (besides in January), the RBA load up meets to discuss whether to raise or lower the money rate, or to keep it on hold. Keeping track of changes to the money rate could provide you with a superior thought of what might end up mortgaging rates in Australia.

Who offers the best home loan rates?

Whether you’re a first home purchaser, a drawn out investor, or need to refinance, finding the best home loan rate is going to be really important for you. Yet, it’s essential to realize that there is nobody “best” rate. As a matter of fact, the right home loan for your financial necessities and spending plan might have a higher rate than others yet offer extra advantages, similar to a bundled charge card or an offset account.

While you’re comparing home loans, attempt to remember that there is more to it than simply the interest rate. Your definition of the best home loan might vary from another person’s. For instance, assuming that you rely upon up close and personal client support you might find that an online-based bank isn’t your best choice – regardless of whether one offered a lower rate loan.

All things considered, there are a few elements that a few borrowers commonly search for in a mortgage. These may change the complete expense of the home loan depending on the number of you center around:

- A below the norm interest rate

- Few, or no, ongoing charges

- Highlights, such an offset account, redraw office or making additional reimbursements

- Information exchange advantages, for example, cashback offers or postponed LMI

- Bundles, for example, linked Mastercards or exchange accounts

For what reason don’t all banks offer the best mortgage rates?

In the event that a low rate is the way in which you define the best Home Loan Mortgage Interest Rate, you might be interested why all banks don’t simply offer absolute bottom rates?

Home loan interest rates are influenced by a few variables, including the Save Bank of Australia’s (RBA) cash rate, market reference rates and store rates. The real home loan rate you will be offered will likewise rely upon your borrower type, your financial record, your store size, and a few other variables.

Likewise, various sorts of home loans might affect the rate. A more fundamental, straightforward loan might accompany a lower interest rate than one with home loan highlights, for instance. Further, more modest loan specialists with less overheads than their large rivals might decide to offer lower interest rates to contend on the lookout. Every one of this becomes an integral factor when a moneylender sets its interest rates and is the reason rates will vary across every bank and each home loan.