Instead of checking our product guide, or any sourcing system, you need to log into Halifax Mortgage Account Number and use Mortgage Enquiry to view the customer’s mortgage. The Product Finder tab will show the products available for a particular customer.

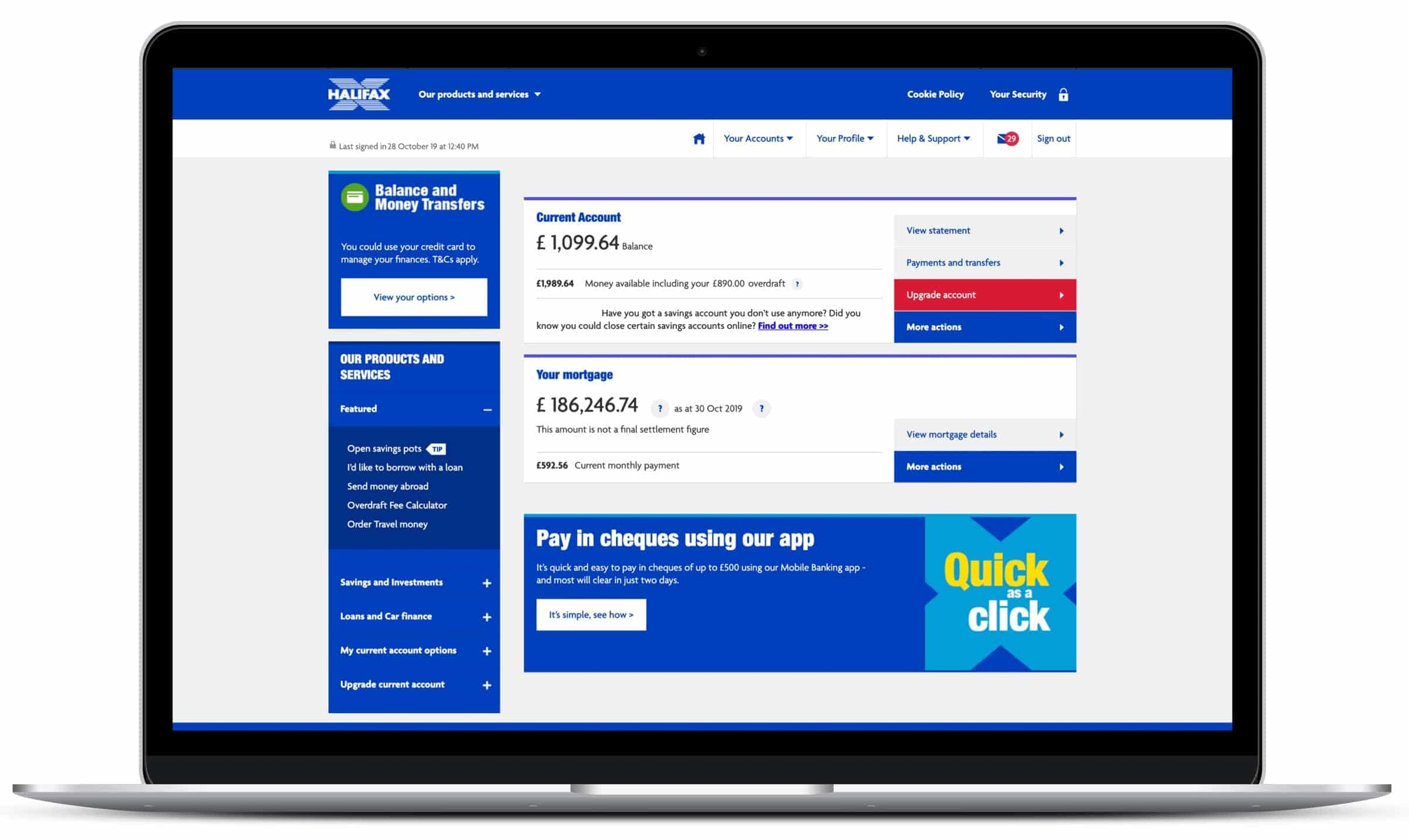

You can get an idea of how much you could borrow and compare rates with our mortgage calculator and tools. You can also check your latest mortgage statement or sign in to Online Banking to view your mortgage details. If you’re not registered for Online Banking yet, it’s easy and only takes about 5 minutes. Find out how to register.

Whichever way you tell us, you’re still covered by the natwest customer service phone number Guarantee offered by all banks and building societies that accept instructions to pay Direct Debits. We’ll also write to you to confirm your Direct Debit Instruction.

The mortgage account fee is an interest-free fee which is charged on new mortgage completions. It doesn’t apply if you’re switching to a new deal or borrowing more against your existing Halifax Mortgage Account Number. It covers the setting up, routine maintenance and closing down of the mortgage account.

How does my mortgage account work?

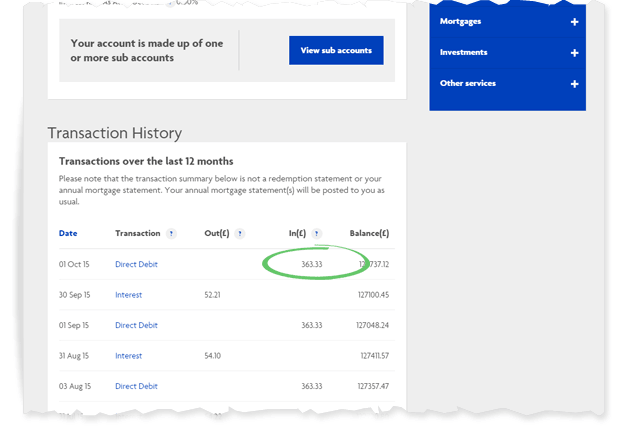

Your mortgage might be a blend of various reimbursement strategies with various loan costs over various mortgage terms. Provided that this is true, your mortgage will be parted into different parts called sub-accounts. Most of our customers will have a sub-account 01 which is their primary mortgage and a sub-account 99 which holds charges. A few customers may likewise have a sub-account 98 in the event that they have a mortgage account charge.

Each sub-account has a different regularly scheduled installment that we total prior to gathering everything from you every month. At the point when we accept your total regularly scheduled installment, we split it and give each sub-account the sum it requirements to guarantee you compensate your premium charges for that month.

For Halifax Mortgage Account Number, every month, your installments go towards diminishing the sum you owe as well as taking care of the premium. Keep in mind, for premium just sub-accounts the equilibrium doesn’t decrease as you’re just taking care of the premium and it’s a necessity that you have a reimbursement plan set up. Find out additional about the various approaches to reimbursing your mortgage.

7 Incredible things about Halifax Item Moves through A Mortgage Now

We can get you a lower remortgage rate

We can get to bring down Halifax Mortgage rates for bigger mortgages that you can’t get immediate from the Moneylender.

We can get to ALL suitable Halifax rates for you

We lay out your mortgage equilibrium and current property estimation and let you in on every one of the rates accessible to you (counting long term fixed rates which are not proposed to you when you manage Halifax).

You can save your new arrangement with us – presently

You can save another Halifax Mortgage Account Number item as long as a half year (changed from 90 days on 5/12/22) preceding your ongoing arrangement closes. Assuming that your new Halifax rate is lower, we might move your item early, setting aside you cash.

You can switch rapidly

We can get your new mortgage remortgage item offer got inside the space of hours as a rule.

There’s no credit check

A Halifax item move is accessible no matter what your new record as a consumer.

Changes in your conditions are not an issue

We can orchestrate a Halifax item move regardless of whether your pay has dropped or one borrower has stopped working.

There’s no requirement for a house valuation

We get a valuation of your property from Halifax, same day, at no expense.

We can orchestrate a re-mortgage in the event that more proper

In the event that the rates proposed to you by Halifax do not suit, we can put you with a more cutthroat loan specialist.

How to Find Halifax Mortgage Account Number

Finding your Halifax mortgage account number is a simple process that can be done in several ways. Here are the steps you can follow to find your Halifax mortgage account number:

- Check your Mortgage Statement: Your mortgage account number is usually listed on your monthly mortgage statement. You can access your statements by logging into your Halifax Mortgage Account Number.

- Contact Halifax Customer Service: If you do not have access to your mortgage statement, you can contact Halifax customer service by calling the number on the back of your debit card or by visiting a local branch. The customer service representative will be able to provide you with your mortgage account number.

- Check the mortgage agreement: Your mortgage agreement should also contain your mortgage account number. If you no longer have a copy of your mortgage agreement, you can request a copy from Halifax.

- Check your credit report: Your mortgage account number may also be listed on your credit report. You can obtain a free copy of your credit report from the major credit reporting agencies in Canada.

By following these steps, you should be able to find your Halifax mortgage account number easily. If you are still unable to find your mortgage account number, contact Halifax customer service for further assistance