A former colleague of mine has a saying that I have since taken on as my Education Loan in USA For International Students on with one financial existence. At the point when families accumulate around their kitchen tables — or almost certain today, their PCs or tablets on Zoom — to examine their finances, they don’t discuss the parts of their accounting reports independently as we frequently do in the policymaking space.

Instead of independently considering youngster care, housing, and education, families have one bottom line: When food and gas get more Study Loan For UK Student Visa, or when a parent needs to slice hours at work to really focus on a kid, something else needs to give.

There is a characteristic impulse to block out the mind boggling rules in general and guidelines around government understudy loans and reimbursement. With confusing reimbursement plan capabilities and always changing, time-restricted extensions for existing borrowers, nobody would fault you for ignoring the best in class declaration.

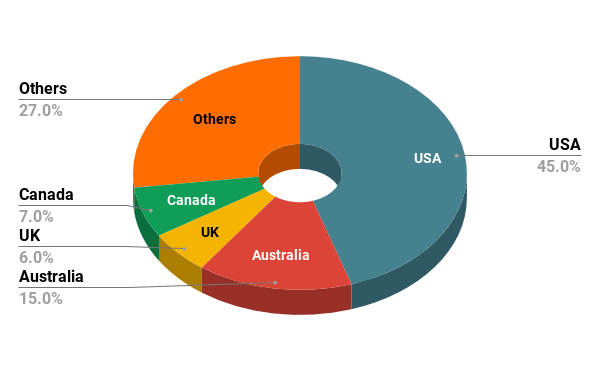

You ought to constantly cautiously assess how much cash you should Education Loan in USA For International Students. Then, at that point, you should investigate and apply for grants, financial guide from your school, and find cash from some other source, including family reserves. In the wake of exhausting these roads, most international students actually have a funding hole, and that is where international understudy loans come in.

What is an International Understudy Loan

Government understudy loans are well known with US students studying in the US, yet they are not accessible to international students. Instead, international students are qualified for international understudy loans, specific private schooling loans accessible to international students studying in the US.

Education Loan in USA For International Students are currently an extremely practical method for financing your education in the US. Loans are truly adaptable, and can offer loan sums sufficiently high to pay for your whole education, however with broadened reimbursement terms and sensible interest rates, so you can afford the reimbursement after you graduate.

Cosigners

Most international students applying for loans should have a US cosigner in request to apply. A cosigner is lawfully committed to reimburse the loan on the off chance that the borrower neglects to pay. The cosigner should be an extremely durable US occupant with great credit who has lived in the US for the beyond two years. The cosigner is in many cases a dear companion or relative who can help with getting credit, since most international students can’t get credit all alone. In the event that you’re not ready to find a cosigner check whether there are no cosigner loans accessible to you.

Interest

Interest is the sum charged by the bank notwithstanding how much cash that you acquired. The interest rate is determined in view of an index in addition to a margin that will add an extra rate interest rate depending on your co-endorser’s creditworthiness. The two most normal indexes utilized for international students are the Superb Rate and LIBOR Rate.

- Prime Interest Rate – This index is determined by the government supports rate which is set by the US Central bank.

- LIBOR – The LIBOR (London Interbank Offered Rate) depends on the English Financiers’ Affiliation and is utilized on the London interbank market. The rate is a normal of the world’s most reliable bank’s interbank store rates for the time being and one year terms.

While evaluating the loan, the moneylender will explain which index the arrangement utilizes. Then, there will be an extra margin that will be added in view of the borrower’s individual models, including the Education Loan in USA For International Students. In view of their creditworthiness, an extra interest rate will be added to the index. This will be the total interest you owe. Whenever your application is supported, your particular margin will be revealed to you, at which point you can acknowledge or deny the loan.

Reimbursement

Reimbursement will shift depending on the loan choice you pick. Since most international students can’t work while they concentrate on in the US, reimbursement should be considered as a critical element in your loan. You should consider how much the regularly scheduled installments will be, when installments will begin, and how lengthy you will actually want to concede paying back the loan. The reimbursement time frame for the most part goes from 10-25 years, yet the bigger the loan, the more drawn out the reimbursement time frame. The standard reimbursement plan choices are:

- Full Deferral – Students can concede installment until a half year after graduation insofar as full-time status is maintained. Students can concede installments for a limit of four years, which is the ordinary length of a degree.

- Interest Just – International students just compensation the interest while in school, up to four continuous years, and can concede the principal until 45 days after graduation, or when the understudy drops their course burden to parttime.

- Quick Reimbursement – Installments on both interest and principal are expected promptly once the loan has been scattered.

Again, this is a major Education Loan in USA For International Students. Understudy loan forgiveness could be nearer than you understand, especially in the event that you have been paying on your understudy loans for quite a while. Try not to pass up this extraordinary chance to free yourself of your remaining understudy loan obligation sooner and less expensive.