Business Loan in USA For Foreigners Here is a staggering stat: 48% of overall development of U.S. business possession in 2000 to 2013 was attributed to immigrant business proprietors. Pair that with the statistic that the percentage of independently employed immigrants in the U.S. dramatically increased somewhere in the range of 1994 and 2015, and follow can’t help thinking that there’s limitless potential for the impact that immigrants can make on the small business landscape.[1] And, fortunately, there are assets to find small business loans for immigrants and grants for immigrants to start a business.

When you have a lot of familiarity with them, you’ll ideally have the option to finance your dream company.

Assuming you’re looking for first-time assist with small business loans and grants for immigrants, you may be feeling overpowered. Although business funding appears as though it takes a specialist to translate, we’ll give you information here that will get you started doing great.

Small business loans can give capital to starting a business. Here, we’ll investigate the various types of small business loans and assist you with getting familiar with loan eligibility necessities before choosing one.

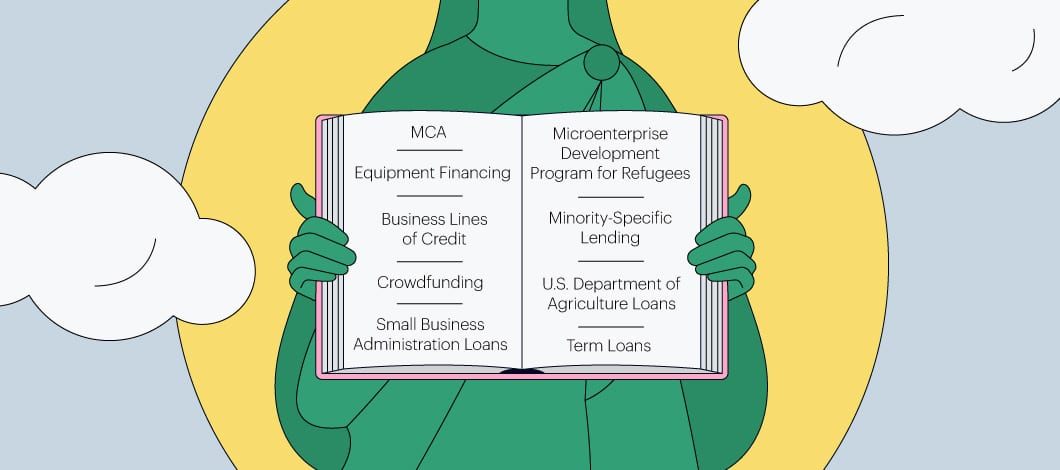

What are the types of business loans?

Not all loan types are available for each business, and each type has its benefits and drawbacks. Here are a portion of the various types of loans you could experience.

Term loans

With a term loan, a financial institution gives you a single amount of cash, and you agree to repay the amount acquired plus interest within a certain time span. Usually, you make regularly scheduled payments on the principal and interest to pay off the loan.

Benefits of business term loans for immigrants

- Access to a large amount of cash after closing

- Potentially larger amount of assets available versus other loans

Drawbacks of business term loans for immigrants

- Often expects you to promise an asset for collateral or to personally guarantee the loan; you may lose the collateral or become personally liable for the obligation assuming you default

- Need to go through the application interaction all finished on the off chance that you want cash again

SBA loans

SBA loans are partially guaranteed by the U.S. Small Business Administration. The backing of the SBA can make financial institutions more willing to loan cash to business visionaries.

Typically, SBA loans are term loans. You can use them for various things like working capital, buying gear, or purchasing real estate.

Benefits of SBA loans for immigrants

- Low interest rates

- Access to funding of up to $5 million

- Long terms that can lead to smaller payments

Drawbacks of SBA loans for immigrants

- Complicated application process

- Severe eligibility guidelines

- Extended wait time for approval

Business lines of credit

With a business line of credit, a loan specialist gives you access to reserves that you can draw from as required. The loan possibly accrues interest when you draw from the line, and you possibly make payments when you access cash. As you pay back the line of credit, the cash opens up for you to draw from again.

Benefits of business lines of credit for immigrants

- Gives you fast access to reserves

- Typically doesn’t need collateral

Drawbacks of business lines of credit for immigrants

- May involve paying annual expenses and additional charges each time you draw from the line

- Severe lending criteria may make many business visionaries ineligible

Who is eligible for business loans?

Eligibility prerequisites for business loans vary from one institution to another. While deciding whether to broaden a loan for another business, banks may consider:

- Creditworthiness of the business proprietor

- Value of assets possessed by the business proprietor

- Value of assets possessed by the company

- Line of business

- Financial projections

- Details of the business plan

Can a foreigner get a loan in the USA?

Indeed, foreigners can generally get loans in the USA However, it depends on each financial institution to determine whether they’re willing to stretch out loans to non-inhabitants or non-citizens.

Depending on the kind of business loan, you will probably have to submit extra documentation in this case.

More tips for applying for business loans

On the off chance that your loan application is denied, first think about the reason for the denial, and check whether there is a way you can address it. Before you apply for a loan, pay attention to your credit history. In the event that you lack personal credit history, work on building your credit in the U.S. before you apply to increase your chances of getting a loan.

How can foreigners in the US get a business loan to start a company?

In their effort to minimize their risk (and maximize their profits) they will want to make sure that they are is a decent chance that they will accept their cash and interest back.

A loan specialist will usually assess the collateral offered as well as the repayment ability of the borrower.

For the collateral, the bank will want to guarantee that its force sale value surpasses the loan by at least 20% so the borrower may have to give additional collateral in the event that the business needs more assets.

For the borrower’s repaying ability, the bank will audit the earnings history of the borrower as well as the ability to create and sustain sufficient earnings later on.

The loan specialist will also make sure that the borrower takes his share of business risk by self-financing at least 20% of the venture/asset. For the same reason personal guarantees are also often required.

How easy is it to get a loan to start a company?

It’s usually not that easy most banks usually want a credit history or a history of business performances

On top of this a few banks see business credit factors, even glance at your personal assets; what you are going to use as colleteral.

Most business usually in the beginning go through a time of credit line opening, and building a relationship with a bank.

For example, obtaining net 30 credit cards with Home Terminal, or another merchant who sells, online merchandise or mail request items.

Be that as it may, these credits just give an extremely minimal amount of credit to business proprietors. The most ideal choice, is to start with a bank that will give even a minimal line of credit.