Last tax season near 70% percent of Advance on My Tax Refund With Turbotax, and the typical government tax refund was near $3,000. For many, their refund could be the biggest single amount of money they receive the entire year, and with the holidays, those assets could be an incredible method for paying off that additional spending.

You can only apply for the Refund Advance if your normal government refund is more than $500. If you don’t have a Credit Karma Money™ Spend account, you will have to open one. Refund Advance sums will change in view of your government return. The maximum Refund Advance loan is $4,000.

Find out about the Life Insurance Payout Taxable website. If endorsed, your Refund Advance will be deposited into your record, which you can spend via a Credit Karma Visa Debit Card.

For many Americans, filing government income taxes means getting a refund. The IRS says that the typical tax refund in 2021 was $2,800 (more than $2,500 in 2020). Taxpayers frequently depend on this money to help their retirement savings or save for a home. Be that as it may, what happens when you really want the money before the IRS sends your refund? You might want to consider a tax refund loan.

It functions like other transient loans, yet the Advance on My Tax Refund With Turbotax on your refund sum. Refund advances are likewise a well known alternative. A financial advisor can assist you with budgeting for surprising costs and proposition advice on dealing with them when they arise.

When will I get my Refund Advance?

You could receive your Refund Advance finances in just one minute after the IRS acknowledges your e-filed government tax return. If you filed your taxes with TurboTax, and picked into information sharing, you can follow your government refund using your Credit Karma account. Your refund tracker will show up not long after you file your government tax return.

You’ll receive an email from Credit Karma when your Refund Advance assets are available to spend. You’ll receive a physical card in the mail in 7-14 days.

Your remaining government and entire state refund (minus any charges you consented to pay to TurboTax) will be deposited to your Credit Karma Money Spend account when the IRS distributes your refund. The IRS issues in excess of 9 out of 10 refunds in under 21 days, however it’s possible your tax return might require additional review and take more time to process.

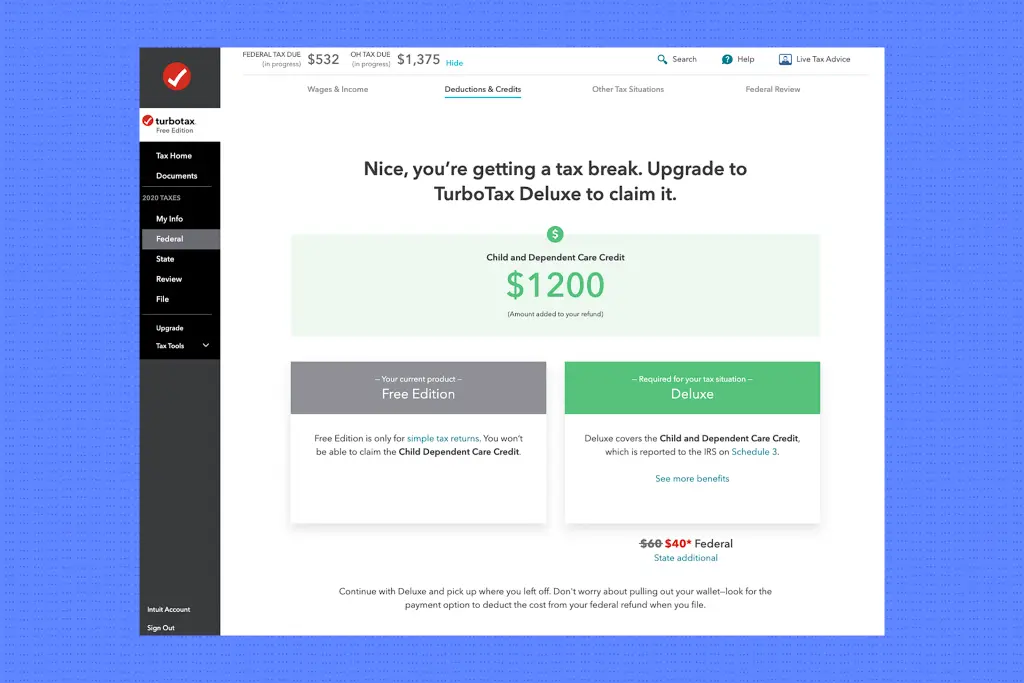

How TurboTax’s tax refund advance functions

As opposed to filling out a different application, you can choose a refund advance as your refund option when you e-file with TurboTax.

You’ll receive your advance on a prepaid debit card, the Advance on My Tax Refund With Turbotax, which will be mailed to you within five to 10 business days. However, Intuit will likewise email you your transitory card information within 48 hours of being supported by the IRS.

Once your refund is handled by the IRS, your other assets will be deposited into a Credit Karma Money checking account — minus the advance you previously received and your tax preparation expense.

How much does it cost?

Intuit TurboTax charges no interest on your refund advance. However, you might have to pay a tax preparation expense to file through TurboTax. The expense relies upon whether you do it without anyone’s help or decide to file with a tax professional. Be that as it may, you don’t need to pay this expense front and center — you can have it removed from your refund after the IRS processes it.

While TurboTax issues its refund on a Advance on My Tax Refund With Turbotax, you can withdraw cash at no expense from its organization of 19,000 ATMs. These are available in each state.

How to qualify

To qualify for a tax refund advance from Intuit TurboTax, you should file your government tax return through TurboTax by February 15, 2023. You likewise need to meet the following requirements:

- Government refund of $500 or more

- No less than 18 years of age

- Not filing as a Connecticut, Illinois or North Carolina resident

- Not filing a 1310, 4852, 4684, 4868, 1040SS, 1040PR, 1040X, 8888 or 8862 structure

TurboTax offers its refund advances through First Century Bank, which might have additional eligibility requirements that are not listed.

TurboTax’s Tax Prepaid Visa Card

All TurboTax offers its online filers the option to receive their refund on a Advance on My Tax Refund With Turbotax. Filers who want an advance on their refund can select to receive a Super Prepaid Visa Card with loan. You simply pick the loan option when you e-file your taxes and then fill out a loan application. (The refund advance loan is a proposal from First Century Bank, N.A., Part FDIC.)

If endorsed, you will receive a loan in how much $250, $500, $750, $1,000, $1,500, $2,000, $2,500, $3,000, $3,500 or $4,000. There is no interest and there are no loan charges. After the IRS acknowledges your return and after your loan application gets endorsed, you will receive your prepaid card, in the mail, in 5-10 business days. It’s worth focusing on that the majority of e-filers will receive a refund from the IRS in only 14 to 21 days, so you might not get the refund advance a lot quicker than you would have received your refund.

Bottom Line

A tax refund loan is a transient loan that you can use to get the worth of your government income tax refund somewhat sooner. They are well known for individuals who claim the Advance on My Tax Refund With Turbotax need a little assist making closes with meeting from the get-go in the year.

However, tax refund loans are not the most ideal option for the vast majority since they are extravagant. In the wake of deducting all expenses and interest, you might need to pay 10% or a greater amount of your refund just to get a loan for a long time. If you truly need some financial assistance, consider getting a refund advance instead. Tax filing services like H&R Block and TurboTax offer big advances at little or no expense for you.