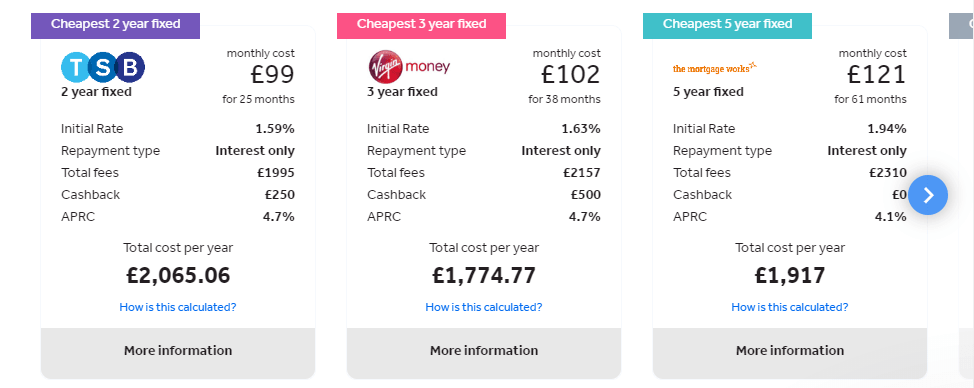

The mortgages underneath show the Interest on Buy to Let Mortgage accessible. The outcomes shown are for interest-only however you can alter this utilizing the channel on the outline. You can likewise personalize the diagram underneath by adding the worth of the property you need to buy and the worth of the mortgage you need to get. In the event that you own a restricted organization, you can likewise find restricted organization buy-to-let mortgages.

Utilize our mortgage affordability calculator with student loans to contrast the options accessible with you, see the different interest rates, mortgage terms and analyze monthly installments. We offer fixed rate mortgages on a capital and interest reimbursement and an interest only premise.

On the off chance that you’re buying a property to lease, you’ll require a buy-to-let mortgage – except if you’ve sufficient money saved to buy by and large. Interest on Buy to Let Mortgage accompany a few critical contrasts to private mortgages. In this way, in the event that you’re considering turning into a property manager, it will assist with having the opportunity to grasps with the nuts and bolts first.

Who can get a buy-to-let mortgage?

On the off chance that you’re wanting to lease your property you will require a buy-to-let mortgage. Numerous moneylenders consider a buy to let mortgage as higher gamble so you might have to require specific conditions to be qualified for one. These commonly contrast from one moneylender to another and may incorporate the accompanying:

- this isn’t generally the situation, however your bank might make it a condition that you currently own your own home, whether by and large or with an extraordinary mortgage

- you ought to have a decent credit record and not extended too much on your different borrowings, for instance, Visas

- you might need to give proof of business pay or income from independent work separate from rental profit. This is regularly around £25,000+ every year – assuming you procure not exactly this you could battle to get a few loan specialists to endorse your buy-to-let mortgage

- moneylenders have a most extreme age necessity which is ordinarily close to 75 years old albeit a few banks might have lower age limits

- a LTV breaking point of no less than 75% so you will require a base 25% store for a buy-to-let mortgage.

- the sum you can acquire depends on the monthly rental you are getting or are probably going to get. Your rental pay ought to cover 125% of your mortgage reimbursements

How do buy-to-let mortgages work?

Interest on Buy to Let Mortgage are a great deal like common mortgages, yet for certain key distinctions.

- The expenses will generally be much higher.

- Interest rates on buy-to-let mortgages are normally higher.

- The base store for a buy-to-let mortgage is normally 25% of the property’s estimation (despite the fact that it can fluctuate between 20-40%).

- Most BTL mortgages are interest-only. This implies you pay the interest every month, except not the capital sum. Toward the finish of the mortgage term, you reimburse the first credit in full. BTL mortgages are likewise accessible on a reimbursement premise.

- Most BTL mortgage loaning isn’t directed by the Monetary Conduct Authority (FCA). There are exceptions, for instance, on the off chance that you wish to let the property to a nearby relative (for example companion, common accomplice, kid, grandparent, parent or kin). These are frequently alluded to as a consumer buy-to-let mortgages and are evaluated by a similar severe reasonableness rules as a private mortgage.

Prompting, orchestrating, loaning and controlling BTL mortgages for consumers is covered under similar regulations as private mortgages and is directed by the Monetary Conduct Authority (FCA)

Who can get a buy-to-let mortgage?

The particular standards relies upon the moneylender, yet, when in doubt, your personal conditions should fall into the accompanying situations:

- You procure £25,000 or more a year, and right now own a home, either mortgaged or inside and out

- You are moderately obligation free, and have a decent FICO rating

You are inside the expected age restrictions. Banks ordinarily have upper age limits for when the mortgage should be reimbursed, which might fall around 70-75, for instance. In this way, on the off chance that you’re 55, you might battle to require out a 25-year buy-to-let mortgage. All things considered, a few banks have been expanding their age cutoff points to empower more established borrowers to take out a mortgage.

How would you track down the best buy-to-let mortgage?

There is an entire pontoon of Interest on Buy to Let Mortgage bargains on offer from banks on the lookout. Once you’ve gotten a handle on the fundamentals, and how much you’re hoping to get, you can look online to track down the best arrangement.

However, numerous investors find it simpler to enroll the assistance of a mortgage merchant, large numbers of whom don’t charge the customer an expense. A buy-to-let bargains are likewise only accessible through an intermediary, and not immediate from a loan specialist.

Check however, that the representative is free and scouring the entire of the market for the best arrangement, instead of simply a restricted board of loan specialists.

Indeed, even once you have gotten the best mortgage bargain, make sure to factor in additional expenses. These could incorporate letting specialist expenses, cash for any fixes on the property before it’s leased, and stamp obligation.