You’ll be able to bet against Bitcoin with an ETF, before you can buy a Bitcoin ETF, There’s uplifting news for individuals who view bad news about crypto as great. Starting tomorrow, you’ll be able to buy an exchange-traded store based on shorting Bitcoin. The financial firm ProShares will make a big appearance the main ETF to allow you to bet against Bitcoin, and it’s set to be recorded on the New York Stock Exchange when the bell opens tomorrow, June 21, under the ticker BITI.

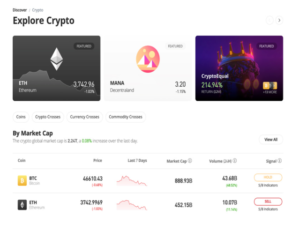

The SEC recently approved a fates Bitcoin ETF, also from ProShares, in October. It appeared alongside the absolute greatest development Bitcoin has seen. Presently, cryptocurrencies have been seriously battling, with Bitcoin, Ethereum, and even stablecoins all experiencing major misfortunes.

What’s amusing about the SEC’s approval of an ETF that can be utilized to short Bitcoin is that it has not yet approved an ETF that actually allows you to trade Bitcoin itself. According to the SEC, you can bet on Bitcoin’s future, bet against it, or… that’s about it. On the podcast Crypto Critics’ Corner Bloomberg Intelligence ETF Analyst James Seyffart said “The SEC has essentially lost the timberland for the trees”.

While it will occasionally approve Bitcoin-related ETFs, for example, the one appearing tomorrow Valorant shows off new underwater, it has so far been reluctant to approve spot Bitcoin ETFs, which would allow you to put resources into Bitcoin all the more straightforwardly. That leaves investors intrigued by Bitcoin depending on odd apps and knowing the intricate details of crypto-wallets.

Presently, because you can gamble against Bitcoin’s future with an ETF doesn’t mean everything is a breeze from here on out for Bitcoin hopefuls and the many image and retail investors who’ve latched their own stars to the cryptocurrency. “Obviously, there can’t be any guarantees,” Michael Sapir, CEO of ProShares told the Wall Street Journal, “yet based on how the fates market has been tracking the spot market, we are hopeful that the backwards item will track well as well.” We’ll have to check whether Sapir’s assessment turns out as expected as the market reacts.

What’s entertaining about the SEC’s approval of an ETF that can be utilized to short Bitcoin is that it has not yet approved an ETF that actually allows you to trade Bitcoin itself. According to the SEC, you can bet on Bitcoin’s future, bet against it, or… that’s about it. On the podcast Crypto Critics’ Corner Bloomberg Intelligence ETF Analyst James Seyffart said “The SEC has essentially lost the backwoods for the trees”.

While it will occasionally approve Bitcoin-related ETFs, for example, the one appearing tomorrow, it has up to this point been reluctant to approve spot Bitcoin ETFs, which would allow you to put resources into Bitcoin all the more straightforwardly. That leaves investors keen on Bitcoin depending on odd apps and knowing the intricate details of crypto-wallets.

Presently, because you can gamble against Bitcoin’s future with an ETF doesn’t mean everything is a breeze from here on out for Bitcoin hopefuls and the many image and retail investors who’ve latched their own stars to the cryptocurrency. “Obviously, there can’t be any guarantees,” Michael Sapir, CEO of ProShares told the Wall Street Journal, “yet based on how the fates market has been tracking the spot market, we are hopeful that the backwards item will track well as well.” We’ll have to check whether Sapir’s assessment turns out as expected as the market reacts.

As indicated above, none of the six ETFs on our rundown own actual Bitcoin. Instead, they hold Bitcoin fates contracts, and at times the shares of companies and different ETFs active in the cryptocurrency space.